All Categories

Featured

Table of Contents

- – How Does Level Benefit Term Life Insurance Wor...

- – What is Simplified Term Life Insurance? Your G...

- – What is Level Premium Term Life Insurance Pol...

- – What is Level Term Life Insurance Meaning? Ex...

- – What Exactly Is Level Term Life Insurance Co...

- – What Does Joint Term Life Insurance Provide?

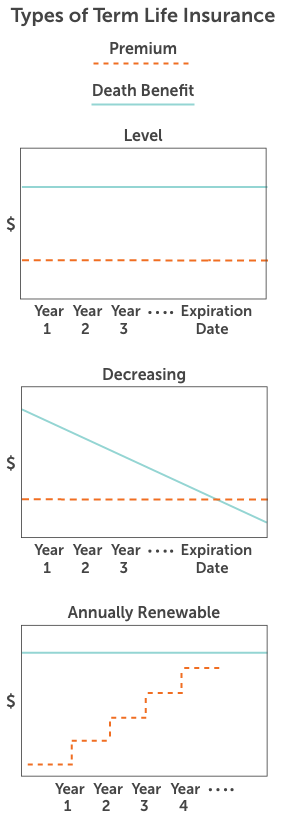

If George is identified with a terminal disease during the very first policy term, he probably will not be eligible to renew the plan when it expires. Some policies supply ensured re-insurability (without evidence of insurability), yet such functions come at a higher expense. There are numerous kinds of term life insurance policy.

Typically, most companies provide terms ranging from 10 to 30 years, although a couple of offer 35- and 40-year terms. Level-premium insurance has a fixed monthly payment for the life of the plan. The majority of term life insurance has a degree costs, and it's the type we've been describing in most of this short article.

Term life insurance policy is eye-catching to young individuals with kids. Parents can acquire significant insurance coverage for a low price, and if the insured passes away while the plan holds, the family can count on the fatality benefit to replace lost earnings. These plans are also appropriate for people with expanding households.

How Does Level Benefit Term Life Insurance Work for Families?

Term life policies are suitable for individuals who desire substantial coverage at a low price. Individuals who own whole life insurance coverage pay a lot more in costs for much less coverage however have the safety of understanding they are safeguarded for life.

The conversion motorcyclist ought to allow you to transform to any permanent policy the insurance business provides without constraints. The main features of the cyclist are preserving the original health rating of the term plan upon conversion (even if you later have health problems or become uninsurable) and determining when and exactly how much of the insurance coverage to convert.

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Of training course, total costs will enhance considerably given that entire life insurance coverage is more expensive than term life insurance policy. Clinical conditions that develop throughout the term life duration can not trigger premiums to be raised.

What is Simplified Term Life Insurance? Your Guide to the Basics?

Whole life insurance comes with significantly greater monthly costs. It is suggested to provide insurance coverage for as lengthy as you live.

Insurance policy companies set an optimum age limit for term life insurance policy policies. The premium additionally climbs with age, so an individual matured 60 or 70 will pay considerably more than a person decades younger.

Term life is rather comparable to automobile insurance policy. It's statistically unlikely that you'll need it, and the costs are money down the tubes if you do not. If the worst happens, your household will get the benefits.

What is Level Premium Term Life Insurance Policies Coverage?

Essentially, there are 2 kinds of life insurance policy plans - either term or permanent plans or some combination of the two. Life insurance firms supply different types of term plans and standard life plans in addition to "interest sensitive" items which have actually ended up being much more widespread considering that the 1980's.

Term insurance gives defense for a given amount of time. This duration could be as brief as one year or provide coverage for a specific number of years such as 5, 10, two decades or to a specified age such as 80 or sometimes as much as the earliest age in the life insurance death tables.

What is Level Term Life Insurance Meaning? Explained in Simple Terms?

Currently term insurance coverage prices are really competitive and among the least expensive traditionally experienced. It ought to be kept in mind that it is a widely held idea that term insurance policy is the least pricey pure life insurance policy coverage readily available. One requires to evaluate the policy terms thoroughly to determine which term life alternatives appropriate to fulfill your particular situations.

With each brand-new term the costs is raised. The right to restore the plan without evidence of insurability is an essential benefit to you. Otherwise, the threat you take is that your health and wellness may weaken and you might be unable to acquire a policy at the very same prices or also whatsoever, leaving you and your recipients without insurance coverage.

The length of the conversion period will certainly vary depending on the type of term policy purchased. The costs rate you pay on conversion is normally based on your "present attained age", which is your age on the conversion date.

Under a level term plan the face quantity of the policy remains the very same for the entire duration. Usually such plans are offered as home loan security with the quantity of insurance policy reducing as the equilibrium of the mortgage decreases.

Traditionally, insurers have actually not can transform costs after the plan is offered. Because such plans may proceed for years, insurance firms must make use of conservative death, passion and expense price price quotes in the costs calculation. Adjustable premium insurance policy, nevertheless, permits insurance firms to provide insurance policy at reduced "present" premiums based upon much less conventional presumptions with the right to change these premiums in the future.

What Exactly Is Level Term Life Insurance Coverage?

While term insurance coverage is designed to supply protection for a specified time duration, permanent insurance coverage is designed to give protection for your entire lifetime. To keep the premium price level, the costs at the younger ages exceeds the actual price of security. This added costs develops a book (cash money worth) which assists spend for the plan in later years as the expense of defense increases above the costs.

Under some plans, premiums are needed to be spent for an established number of years (Term life insurance for spouse). Under other plans, premiums are paid throughout the insurance policy holder's lifetime. The insurance policy firm invests the excess premium bucks This kind of policy, which is in some cases called cash money worth life insurance policy, produces a cost savings aspect. Money values are crucial to an irreversible life insurance policy.

Often, there is no relationship between the size of the cash worth and the premiums paid. It is the cash value of the policy that can be accessed while the policyholder is to life. The Commissioners 1980 Standard Ordinary Death Table (CSO) is the present table made use of in computing minimum nonforfeiture values and policy books for average life insurance policy plans.

What Does Joint Term Life Insurance Provide?

Lots of permanent plans will certainly include stipulations, which specify these tax obligation demands. There are 2 standard categories of permanent insurance coverage, conventional and interest-sensitive, each with a number of variations. In addition, each category is generally readily available in either fixed-dollar or variable form. Standard entire life policies are based upon lasting price quotes of cost, rate of interest and death.

Table of Contents

- – How Does Level Benefit Term Life Insurance Wor...

- – What is Simplified Term Life Insurance? Your G...

- – What is Level Premium Term Life Insurance Pol...

- – What is Level Term Life Insurance Meaning? Ex...

- – What Exactly Is Level Term Life Insurance Co...

- – What Does Joint Term Life Insurance Provide?

Latest Posts

Life Insurance Policy Instant Quote

How Does Burial Insurance Work

Funeral Plan Insurance

More

Latest Posts

Life Insurance Policy Instant Quote

How Does Burial Insurance Work

Funeral Plan Insurance